1.1. Analysis of Real Estate Market in 2009

There has been a lot of speculation in newsletters and on the national television regarding the real estate price slump in Romania in 2009. After more than one year of financial crisis and global recession, this seems to be the fact: the romanian housing market havily went downhill, according to the Romanian National Union of Public Notaries (UNNPR). Between the 1st of January and the beginning of September 2009, transactions were down by almost 36% comparing to the same period of time in 2008, from 484.765 to 310.249. In reality, in Bucharest, the prices didn’t go that down, except for the flats located in the old buildings and in certain locations far from central city.

This year, because of their lack in transactions and the flat taxes, almost 7000 real estate agencies stopped their activity. Every firm with four employees or less has closed its doors and former agents have chosen other sales activities or ensurance. Since most of the companies have reduced their personnel and cut down most of their salary expenses, it is easier to gain awareness by being one of the few companies actively communicating in this period.

Due to the very strict conditions that ordinary people have to meet in order for them to take a mortgage or to make a common loan, the number of buyers who actually qualified for this kind of actions decreased considerably, causing the aforementioned steady downturn of the prices for old apartments.

Despite the fact that massive media campain was announcing a disastrous year for real estate developers, some of them managed to keep a constant pulse of constructions and sales. How? They mindfully analysed the romanian economic texture, they well identified the needs and the financial possibilities of the clients and, much more important, they adapted themselves to any new conceived financial strategy like the “First Home” program, one of the very few impulses that the government gave to romanian real estate market in 2009.

1.2. Facts and figures

The banks in Romania took the commitment to grant using the “First Home“ program more than 23.000 loans, comparing to 16.000 loans, as much as the government could guarantee. There are the main banks involved in this program and their assigned budgets: BCR (450 million Euro), Banca Transilvania (25 million Euro, at least in the first phase), Raiffeisen Bank (50 million Euro), Millennium Bank (30 million Euro), Piraeus Bank (100 million Euro), CEC Bank (400 million Euro), Alpha Bank (100 million Euro), UniCredit Tiriac Bank (25 million Euro), OTP Bank (5 million Euro), Bank Leumi (10 million Euro), ATE Bank (5 million Euro), Credit Europe Bank, BRD (200 – 250 million Euro), Garanti Bank (50 million Euro), Volksbank (75 million Euro), Intesa SanPaolo (75 million Euro), Bancpost (50 million Euro).

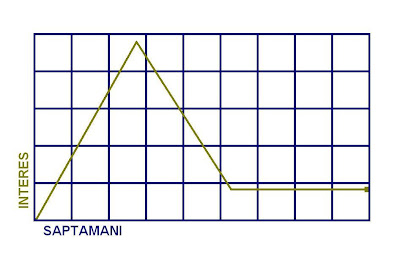

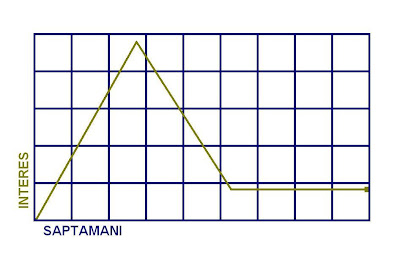

Evaluarea unei proprietati imobiliare ce urmeaza a fi propusa spre vanzare are repercusiuni directe asupra ritmului in care decurg prezentarile acesteia. Astfel, identificam trei situatii:

1) Daca proprietatea propusa spre vanzare nu este prezentata, inseamna ca brokerii imobiliari considera ca pretul anuntat este prea ridicat pentru acea zona.

Recomandare: O ajustare semnificativa a pretului.

2) Daca proprietatea este prezenata, dar nu exista contraoferte, inseamna ca potentialii cumparatori gasesc oferte mai interesante pentru aceasta suma.

Recomandare: O ajustare moderata a pretului.

3) Daca proprietatea este prezentata intr-un ritm constant accelerat, dar potentialii cumparatori, in urma unor duble vizionari, aleg in favoarea altor oferte, inseamna ca suntem aproape.

Recomandare: O ajustare minora a pretului.

· Conform National Association of Realtors®, daca o proprietate este corect evaluata, ar trebui sa primim cel putin o contraoferta la fiecare zece prezentari.

· In contextual unei piete imobiliare normale, ar trebui sa avem una sau doua prezentari pe saptamana.

2009 Design by Free CSS Templates | Blogger Templates by TeknoMobi.